Home Buying Tips for 2026: What Smart Buyers Are Doing Right

Buying a home in 2026 looks different than it did just a few years ago. With shifting interest rates, evolving market conditions, and more digital tools than ever, today’s buyers need a smart, strategic approach.

Whether you’re a first-time buyer or moving into your next home, here are the most important home buying tips for 2026.

1. Get financially prepared first

Check your credit and finances. A strong credit score and steady income help you secure better mortgage terms.

Save for a down payment and costs beyond it. Don’t forget closing costs, inspections, taxes, insurance, moving, and early repairs. Remember YOU DON’T NEED 20% DOWN.

Get pre-approved (not just pre-qualified). Pre-approval shows sellers you’re serious and clarifies exactly what you can afford.

2. Realistically define your budget

Stay within a budget you can comfortably manage long term — don’t stretch so far that monthly costs squeeze your lifestyle. When I start working with buyers, I ask them what payment would be comfortable for them. Then I work backwards to find out what purchase price would be ideal.

Remember: the mortgage payment isn’t everything — property taxes, insurance, HOA fees, maintenance and utilities matter too.

Smart Shopping in 2026

3. Take advantage of current market conditions

Inventory is expected to improve in many areas in 2026, giving buyers more options and potentially more negotiating leverage.

4. Be open to flexibility

Look beyond single-family homes to condos, townhomes, or energy-efficient/modular options — they might offer better value.

Consider homes that have stayed listed longer. Homes with less competition sometimes mean stronger negotiating power.

5. Think long-term

Focus on location quality, resale potential, and lifestyle fit, not just short-term price swings.

Even if you plan to move later, choosing a home that holds value (good schools, transportation access, strong job markets) pays off.

Work with Professionals

6. Partner with an experienced agent and lender

A good real estate agent can help you interpret local trends, craft competitive offers, and avoid costly mistakes.

A mortgage specialist can help find the best loan type for you and advise on rate-locking strategies.

Final Thoughts

The best home buyers in 2026 are informed, financially prepared, and patient.

Success isn’t about rushing into a deal—it’s about making a confident, well-planned decision that supports your long-term goals.

If you approach the process strategically, 2026 can be a great year to buy.

What is the time frame to close on a house from start to finish once you submit an offer?

The time it takes to close on a home — from start to finish — can vary, but here’s a clear breakdown of the typical timeline and what affects it:

🕒 Average Total Time

30 to 45 days is standard for most financed home purchases (using a mortgage).

1 to 2 weeks is possible for cash purchases, since there’s no lender involved. During this process you are waiting on title and inspections.

📋 Typical Steps and Time Frames

⚙️ Factors That Can Speed Up or Slow Down Closing

✅ Cash buyer: No loan process = much faster (7–14 days).

🚫 Loan issues or appraisal delays: Can add 1–3 weeks.

🏡 Title problems or repairs: Can delay closing until resolved.

📑 Buyers and sellers being responsive: Quick document turnaround helps keep things moving.

What types of programs are offered to help get buyers into homes?

Different banks offer different programs to help with home ownership. Below are a couple options homeowners can look at.

Wheda in Wisconsin offers you 100% financing with their Down Payment Assistance Programs. If you would like more information on these programs please reach out to me or Katie Strom with Prosperity Home Mortgage. Katie’s number is 651.468.5127, email katie.strom@phmloans.com

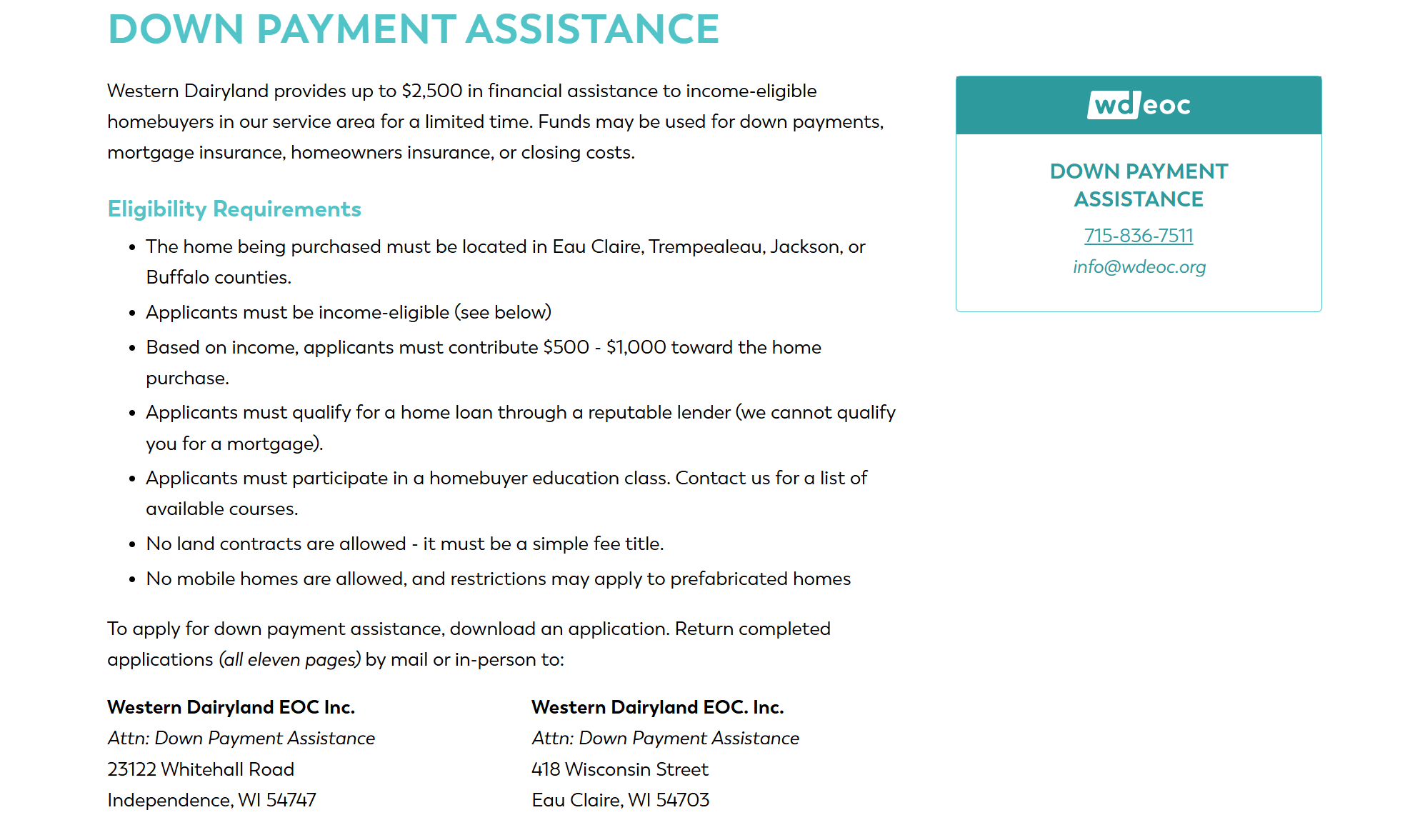

Below is a down payment assistance program offered through Western Dairyland.

Is there a typical down payment needed?

The typical down payment for a home varies widely depending on loan type and buyer circumstances:

0% Down: Available for VA and USDA loans, typically for veterans or rural properties.

3%-5% Down: Conventional loans start at 3% for first-time buyers, while insured conventional loans require 5%.

3.5%-10% Down: FHA loans need 3.5% with a credit score of 580+ or 10% for lower scores.

20% Down: Avoids private mortgage insurance (PMI) but is not mandatory.

Another loan option in Wisconsin is Wheda, Wheda is a down payment assistance program that helps buyers with their down payments.

The median down payment in 2024 was 8%, or $26,700